April 03, 2023 | Industry News

April 2023 Regional Market Report News

Crop Updates

Anchovies

The La Niña conditions that had adversely affected the availability of anchovies in Peruvian waters have ended, and the regions now enters a period of El Niño conditions. Our partners are already reporting improvements in anchovy availability due to the change in conditions. With these improvements, we are hopeful this category will be fully recovered by early summer but will continue to monitor the situation closely.

Baby Corn

Heavy rain in Thailand has forced farmers to minimize planting efforts, causing severe crop shortages of baby corn. To sustain product availability and inventory levels, we have strategically switched our focus and are relying heavily on our Vietnamese partners who are experiencing much more favorable conditions than those in Thailand.

Global Supply Chain and Logistics Updates

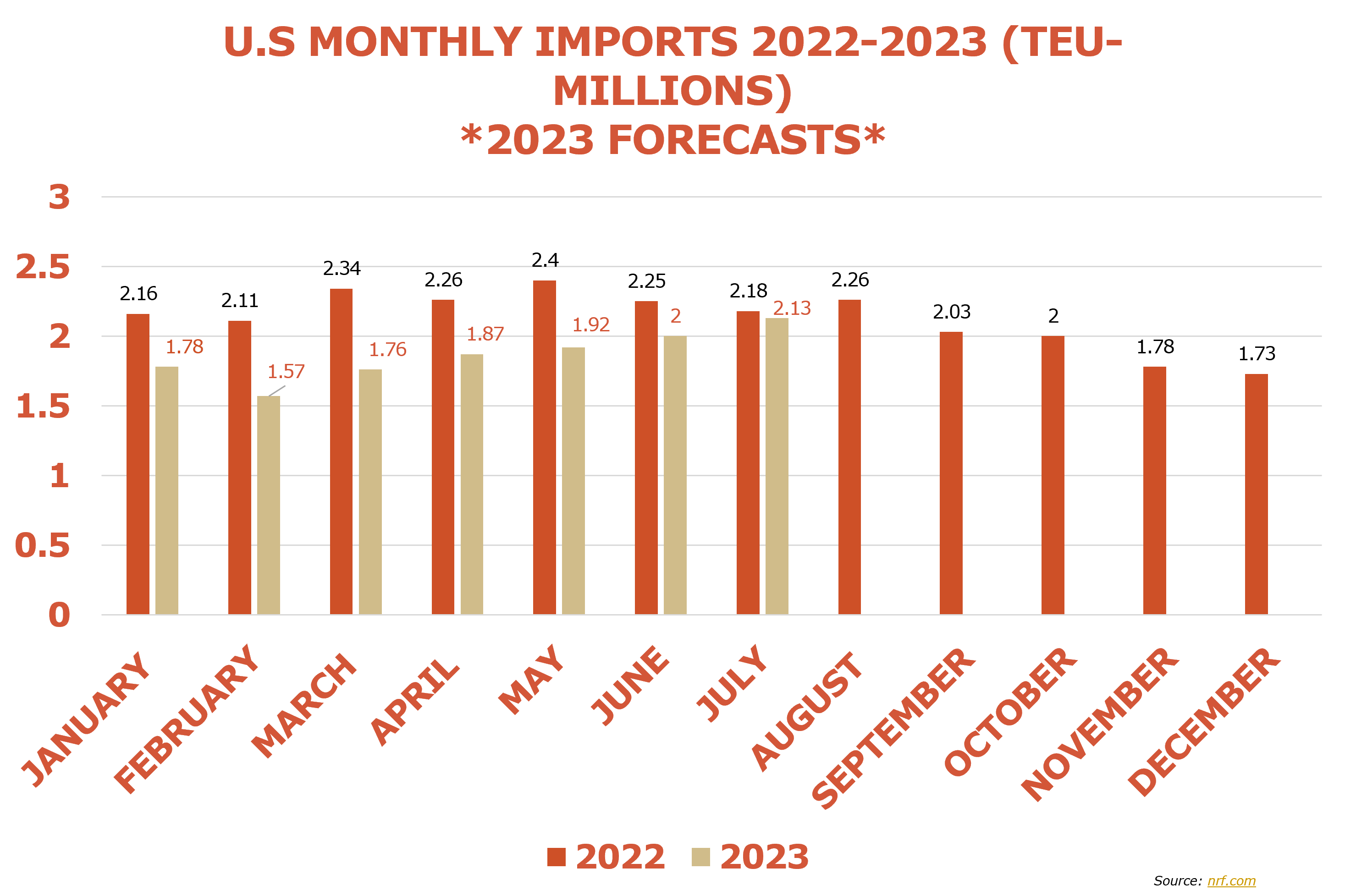

Containerized Imports Predicted to Rise

As anticipated, containerized imports in February were significantly lower than those in January. High inventory levels, inflation, and fuel costs have all contributed to slowed retail orders. However, March brought a rise in imports, indicating a return to pre-pandemic shipping cycles. If this continues, imports will slowly climb until reaching their peak during mid-summer.

Two Key Factors in Future Supply Chain Performance

Two distinct shifts will impact the supply chain moving forward – a shift in import origins and U.S. port performance changes.

Imports from China appear to have peaked, resulting in attempts from retailers to source from alternative countries. In February of 2022, China represented 41.5% of all U.S container imports, which dropped to 36.5% in February 2023. While the U.S will continue to rely heavily on Chinese exports, it is important to note retailers have begun to search for other options.

Domestically, the East and Gulf coast ports continue to outperform West Coast ports in imports. As a reminder, in July 2022, West Coast unions failed to negotiate a new labor contract with their respective ports and threatened to strike. Out of caution, shipping lines began to limit sailing to West Coast ports and in turn sailed to the East Coast of the United States. There is still no finalized labor agreement with the port workers and unions. It is possible West Coast ports will sustain a permanent loss of business and volume diverted to the East coast may not all return.

At Roland Foods we are aware there may be more challenging times ahead, but we will work to maintain a flexible and responsive transportation network capable of adapting to any environment.

Sources: