November 01, 2022 | Industry News

November 2022 Regional Market Report News

INDUSTRY NEWS

Crop Updates

Arborio Rice

The drought conditions in Italy in 2022 have resulted in low crop yields throughout the country, specifically the Arborio Rice crop. The total yield for Arborio in a typical year is ~180,000 metric tons and the 2022 yield is closer to 88,000 tons. This shortage of raw material has driven up the price of raw material by more than 50% as growers are limited the quantities that are being sold to production facilities. Packers are forced to work on the spot market, unable to secure long-term pricing in the early portions of the 2022/2023 season.

In spite of these challenges, Roland Foods is relying on long-term relationships with our key supplier partners in this region to stay close to the situation. In fact, our Procurement team visited the production facilities in Italy this month to get a better handle on the situation on the ground and we are in constant communication with our partners to ensure we receive the product we need to keep our customers in stock.

For more information about Arborio Rice, visit Washington Post.

Olive Oil

Due to severe droughts across Europe, this year’s Spanish olive oil yield is estimated to be 20-50% lower than last year. The United States Department of Agriculture forecasts a 14% drop in global olive oil production, while projections for Spain specifically are even higher. Kyle Holland, a pricing analyst for oilseeds and grains at Mintec, a commodities data company, expects a "dramatic reduction" of between 33% and 38% in Spain's olive oil harvest that begins in October (CNN).

Given that Spain is the world’s largest producer of olive oil, a low harvest will have a ripple effect, including increased price of olive oil from Spain, Italy, Tunisia, and Morocco. Although prices are high for Greek olive oil, the harvest in Greece is promising.

At Roland Foods, we're always working to secure raw material to mitigate passing along cost increases to our customers.

Global Supply Chain and Logistics Updates

Labor Contracts Remain Unresolved, Sending All Parties Back to the Bargaining Phase

As mentioned in previous Bulletins, the third largest union (Brotherhood of Maintenance of Way Employees Division of the Teamsters) representing about 26,000 freight rail workers, has voted against the latest labor contract, on the premise that the new contract does not meet the quality-of-life conditions necessary (such as increased travel allowances and more flexible sick/paid time off). This puts the union back into a bargaining phase. Both sides have agreed to continue working without disruption, and the earliest possibility for a strike would be November 19th.

Supply Chain Issues Ease, But Some Problems Remain

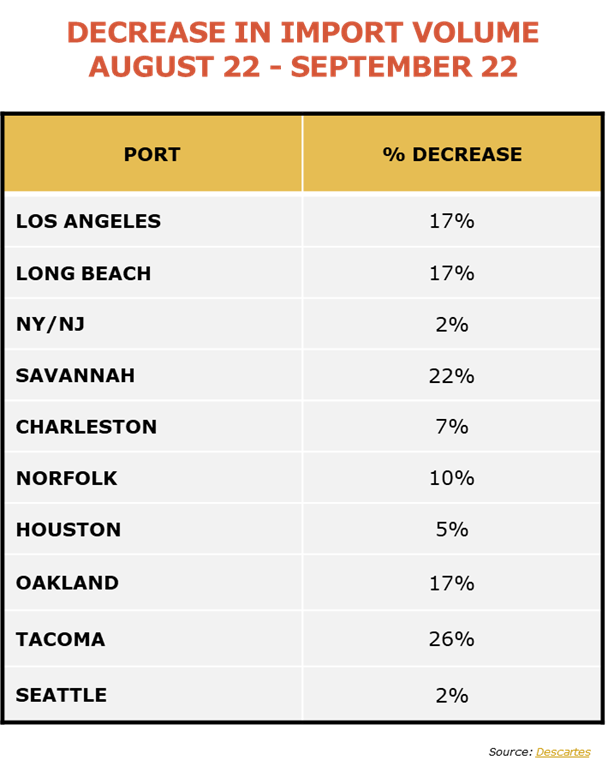

September 2022 marked the largest drop in U.S import volume since the initial global shutdown of Q1 2020. The below chart is based off preliminary data that may slightly change as it is reviewed, but signals we are likely on the road to pre-pandemic import behavior. Despite the drop, it should be emphasized import volumes are very high when compared to historical averages, signaling the U.S. economy is strong.

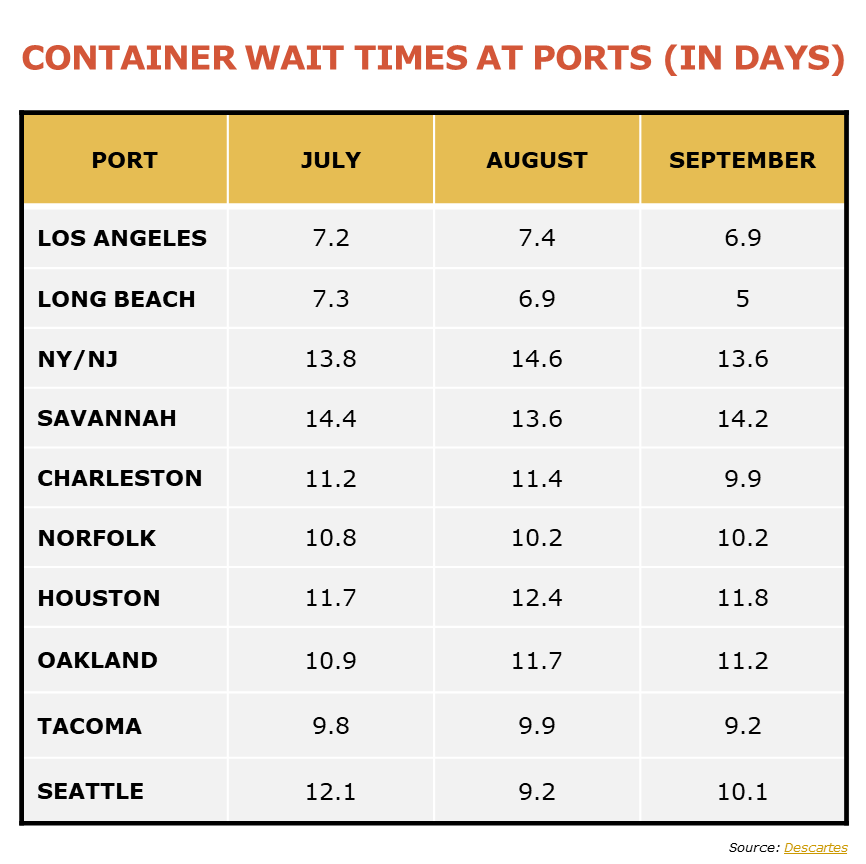

Despite the significant drop in container volume, it will still take several months, if not quarters, of import regression to fix congestion and transportation delays. West Coast ports are leading the pack in reducing port delays, while East coast ports are still experiencing 10+ day delays.

The situation for intermodal cargo transported by rail has showed little consistent improvement with a one step forward two steps back dynamic. The September container data gives hope rail networks can begin to catch up to the backlog and make progress to restore reliability, but this of course will be a slow and gradual process that will takes months to fully restore, even in ideal conditions.

At Roland Foods we have taken a strategic approach to rebalance our inventory and allocate more volume to multiple locations across the country. This strategy helps keep our product moving reliably despite any regional supply chain disruptions that may arise. The past two years have displayed that reliability is a priority and organizations must remain flexible to satisfy customer demands.

Source: